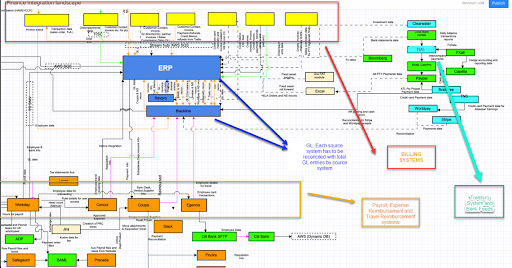

A solid finance transformation begins by reducing unnecessary complexity and clearly defining the scope of each project (Finance Transformation). Outlining what you want from each system helps you avoid bloated processes, ensures clearer ownership, and streamlines decision-making across all finance functions. By setting scope early, you avoid a lot of needless discussions on what data exists where. Now when you see a finance solution diagram like this for a large company, its a headscratcher, how would you make sense of this !

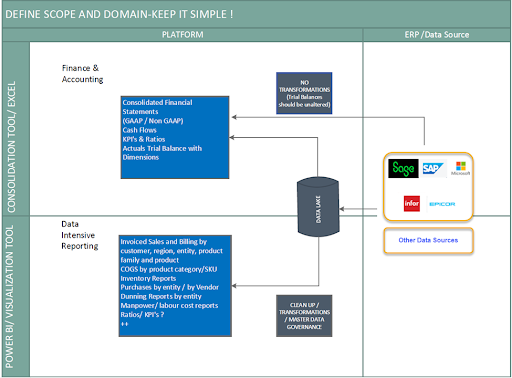

The goods news is that all of this level of complexity does not apply to most companies. A mid size company need to visualize end state and work backwards in the most simplistic manner Here is a guideline of where financial reporting should exist and where high frequency data needs to be reported

Let's take the example of a group of companies with one holding company and three subsidiaries

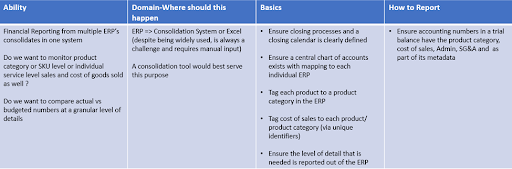

Ask the team what they want to achieve and bucket it as following

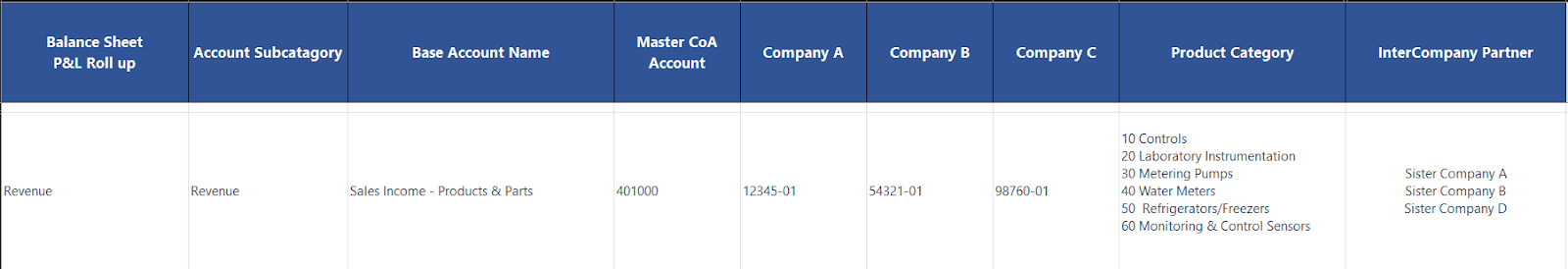

What would a Master CoA to Subsidiary Account mapping look like?

A simple master CoA mapping with subsidiary company A,B and C

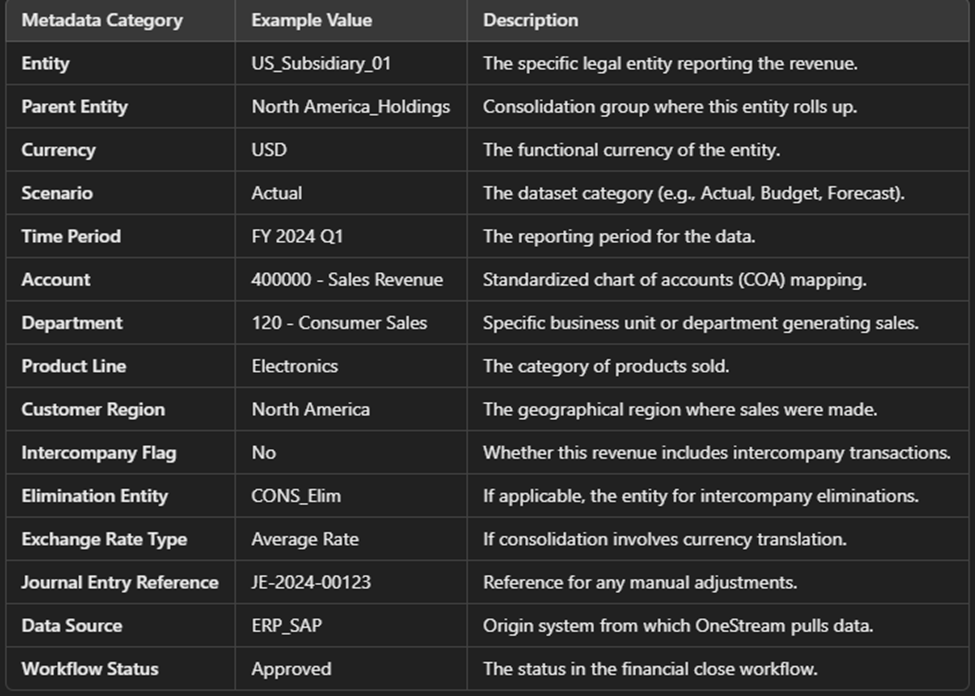

Here is the fancy definition

Metadata refers to structured data that defines and describes financial, operational, and structural aspects of entities, transactions, and reporting within the system. It ensures consistency, accuracy, and transparency in financial consolidation processes.

Here is the simple definition

Metadata is data about data. For example: When we talk about accounting, take the number $10,500,000. The data about this number could be:

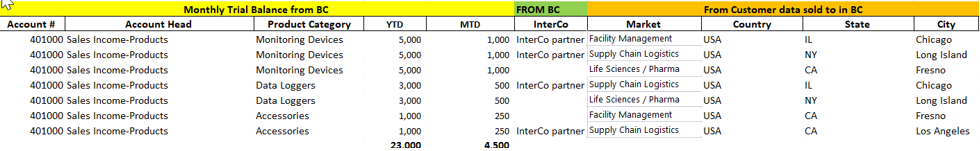

Let's visualize what your ERP would need to produce (or you need to stitch together) for producing a detailed Trial Balance with Account Number, Account Name, Product Categories, Markets and Location. Note: Each amount in a trial balance should have the metadata you want reported as a separate line item

Now imagine what a variance analysis with detailed information would need to look like to compare actuals vs forecast. Timely, accurate, and insightful reporting underpins every effective finance transformation. Start by consolidating data sources to present a single version of the truth and reduce the manual effort of juggling multiple spreadsheets. Standardized processes and consistent data definitions further strengthen the integrity of financial statements, while clear governance structures outline accountability for data preparation and review.

1. Define scope and boundaries and then Simplify!

2. If management wants a certain level of detail or granularity that must reflect in the metadata provided from your accounting system or ERP and planned at the same level