In today's volatile FX markets, managing corporate balance sheet exposures has become increasingly complex. With multiple currencies, changing regulations, and the need for real-time decision-making, treasury teams are under pressure to deliver more with less. That's why we've reimagined our balance sheet hedging workflow from the ground up.

For multinational corporations, foreign currency exposures aren't just numbers on a spreadsheet—they're real risks that can materially impact earnings. A typical corporate treasury manages:

The traditional approach? Endless spreadsheets, manual calculations, and emails flying between systems. Not anymore.

We've implemented a streamlined process that connects the ERP, Treasury Management System (TMS), trading portals, and confirmation platforms into one seamless workflow. Here's how it works:

No more manual downloads. Foreign currency GL balances flow directly from our ERP into the TMS, ensuring accuracy and saving hours of reconciliation time.

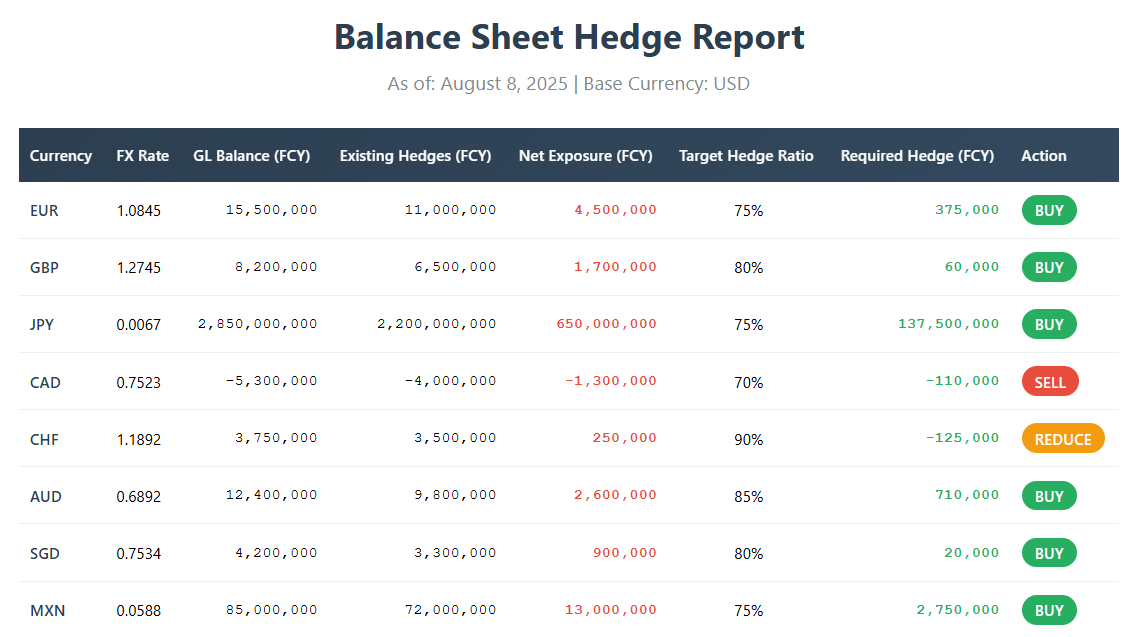

Our system automatically calculates net exposures by comparing GL balances against existing hedges. The result? A clear view of exactly what needs to be hedged, by currency, in real-time.

Based on board-approved hedge ratios, the system generates precise hedge requirements. For example, if we're targeting 75% coverage on EUR exposures and currently have €11M hedged against €15.5M exposure, it automatically calculates the €375,000 additional hedge needed.

Approved trades flow directly to our trading portal. No re-keying data, no transcription errors—just clean, accurate trade requests ready for execution.

Post-trade, confirmations are automatically matched and exceptions flagged, closing the loop on the entire process.

Since implementing this integrated workflow, we've seen:

Integration is Everything: The real value comes from connecting systems, not just implementing them in isolation.

Standardize Before You Automate: We spent time upfront standardizing our hedge ratios and approval processes. This foundation made automation possible.

Think Beyond Efficiency: Yes, we saved time, but the real win was improved control and risk management.

Change Management Matters: Getting trader buy-in early was crucial. We involved them in design sessions and addressed their concerns upfront.

Start with Clean Data: Garbage in, garbage out. We invested in data quality at the source (ERP) before building downstream processes.

This is just the beginning. We're now exploring: